Management Dept. imposes new syllabi; Legal Management to retrieve

August 6, 2020

How to use Zoom and Canvas

August 13, 2020CPALE Postponed to 2021; coverage revised for 2022

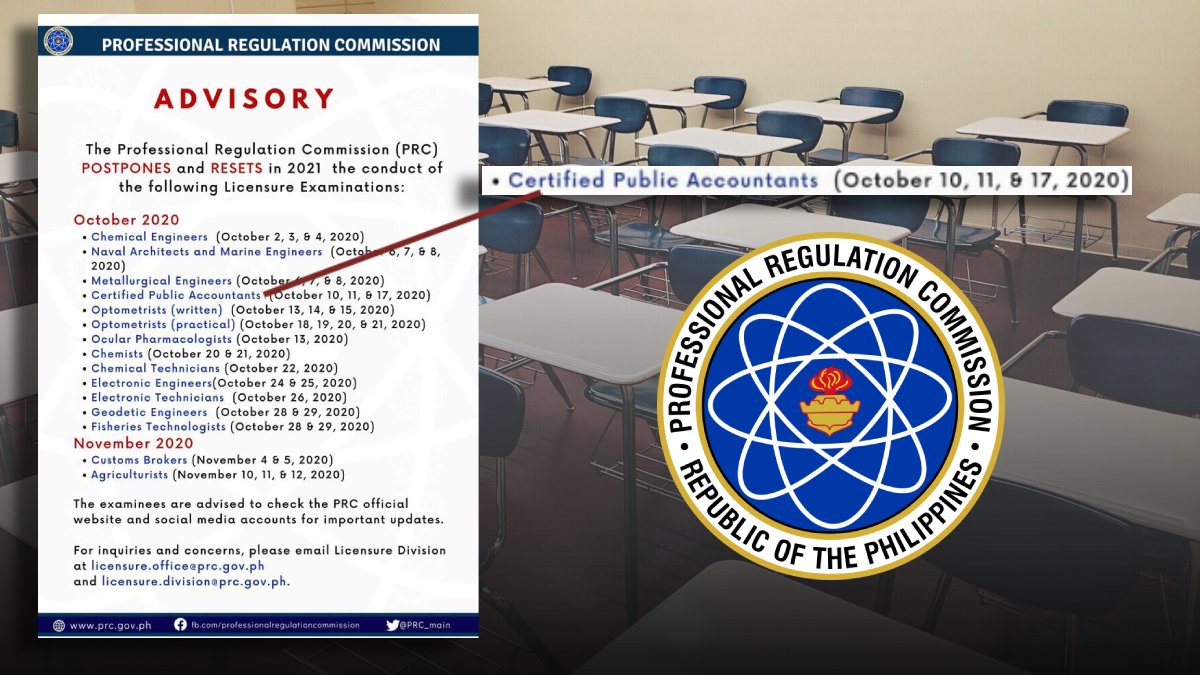

The Professional Regulation Commission (PRC) announced the deferment of the upcoming Certified Public Accountant Licensure Examination (CPALE) in 2020, still due to the rising COVID-19 cases in the country last August 9, Sunday.

Fear and anxiety to the health and safety of all concerned individuals of the upcoming licensure examinations were the concern of the PRC in deciding to reset the upcoming exams to next year considering the 22,000 examinees of the October 2020 CPALE alone.

Meanwhile, the proclamation of the Board of Accountancy (BOA) with the Revised Syllabi and Tables of Specifications of the licensure exam effective beginning October 2022 trended on Twitter last Saturday.

Some notable changes proposed by BOA for final approval of the PRC include the removal of the following: “Updates on Special Concerns”; Tariff and Custom Codes under Tax; and Standard Costing under Advanced Financial Accounting and Reporting (AFAR), and the Negotiable Instruments under Regulatory Framework for Business Transactions (RFBT).

Concurrently, the revisions include the addition of the following: Auditing Practice that contains governance, ethics, and quality management under Auditing; Laws and Consumer Protection, Financial Rehabilitation and Insolvency, Philippine Competition Act, Government Procurement Law, Truth in Lending Act, Labor Law, and Social Security Law under RFTB; Bases Conversion and Development Act under Tax; and Financial Market under Management Advisory Services (MAS).

The released proposed changes on the coverage alarmed most of the concerned individuals on Twitter, especially the Accountants and Lawyers due to the wide range of the new syllabi.

“With the new RFBT syllabus, CPA [Certified Public Accountant] candidates will be able to cover roughly 40% of the Bar syllabus on Civil Law, 80% of Commercial Law, 50% of Labor Law, and of course, Taxation,” Atty. Kenneth Manuel, one of the CPA topnotchers of the recent bar exam, said.

“By my calculation, CPA candidates would be able to study 1/3 of the entire Bar Exam syllabus,” he added.

“I just saw the changes in CPALE Syllabi by Oct. 2022 and with all the changes especially in the RFBT and Tax, it seems like most of the passers during that time will just go straight to law school,” Twitter user @multidanii expressed.

Many aspiring CPAs are keeping their hopes up for the upcoming licensure exam and in increasing the passing rate as compared to the previous CPALE.

Examinees are asked to stay updated with further details to be announced by the PRC.

LAYOUT BY: Cristine Joie Q. Bacud

PHOTO SOURCE(S): pixabay and Professional Regulation Commission (PRC)